The integration of artificial intelligence into data extraction from financial documents presents both immense potential and significant challenges. This article delves into the complexities involved in deploying AI technologies for this crucial task, examining the technological hurdles, financial investments, and accuracy concerns that firms face. While advancements in AI offer promising solutions, the implementation process is anything but straightforward.

The Promise of AI in Data Extraction

Increasing Efficiency

One of the most enticing prospects of using artificial intelligence for data extraction is the potential boost in efficiency. AI has the capability to automate many labor-intensive tasks, thus reducing the time required for manual data handling. Automation not only accelerates processes but also diminishes the probability of human error, which is a critical factor in maintaining the integrity of financial records. This aspect of AI is particularly appealing for companies dealing with large volumes of financial documents that require meticulous scrutiny and accurate extraction of pertinent details.

The gains in efficiency are evident when considering the routine operations within financial institutions. Tasks like parsing through Securities and Exchange Commission (SEC) filings, extracting critical data points, and ensuring that all regulatory requirements are met can be overwhelming without automated support. AI systems, equipped with sophisticated algorithms, can perform these tasks with higher speed and accuracy, allowing firms to reallocate human resources to more strategic initiatives. The efficiency derived from AI could translate into significant cost savings, making it an attractive proposition for businesses looking to optimize their operations.

The Growing Capabilities of AI

Recent years have witnessed remarkable advancements in artificial intelligence and machine learning, particularly in generative AI models and large language models (LLMs). These models have demonstrated an impressive ability to process and understand vast quantities of text with unprecedented speed and accuracy. Their ability to learn from large datasets and generate human-like text makes them suitable for various applications, including the extraction of data from complex financial documents.

AI’s evolving capabilities promise a future where machines can comprehend financial texts with a level of understanding that rivals human experts. For instance, generative AI models are now capable of summarizing lengthy financial reports, identifying critical information, and sorting through contextual nuances that were once exclusively handled by human analysts. This transformative ability can be leveraged not only to improve the extraction of data but also to derive meaningful insights that can inform decision-making processes within financial institutions.

Technological Hurdles

Customization Requirements

Despite the impressive potential of AI, its implementation for data extraction in financial documents presents notable customization challenges. Off-the-shelf AI solutions often fail to meet the highly specialized needs of financial institutions, which necessitate significant tailoring to align with specific data requirements and regulatory standards. The generic nature of these AI tools may not be sufficient to handle the intricacies and uniqueness of each financial document, thereby necessitating extensive adjustments.

Customization is essential to ensure that AI systems can accurately interpret and process data specific to financial institutions. This involves adapting the AI to handle various document formats, terminologies, and context-sensitive information that are unique to each client. Tailoring AI solutions to fit these criteria requires a deep understanding of both the technology and the financial domain. The development of such customized systems involves considerable effort, including adjusting algorithms, training models with domain-specific data, and fine-tuning the systems to meet the stringent accuracy standards expected in the financial sector.

Infrastructure and Expertise

Integrating AI into data extraction workflows is not just about embedding sophisticated technology. It also demands a robust infrastructure and specialized expertise to ensure seamless operation and maintenance. Financial institutions must invest in high-performance computing infrastructure capable of supporting complex AI algorithms and processing large datasets efficiently. This includes setting up servers, data storage solutions, and networking capabilities that can handle the computational demands of advanced AI models.

In addition to technological infrastructure, the successful deployment of AI for data extraction requires skilled personnel who possess expertise in both AI and finance. Data scientists, AI engineers, and financial analysts must collaborate to design, implement, and maintain AI systems. The expertise required goes beyond mere technical know-how, encompassing a deep understanding of financial regulations, document structures, and the specific needs of the institution. This multidisciplinary approach ensures that the AI systems are not only effective but also compliant with industry standards and regulatory requirements.

Financial Investments

Initial Costs

Embarking on the journey to develop a reliable AI data extraction system involves substantial initial costs. These expenses extend beyond the mere purchase of technology or AI software licenses. Financial institutions must also allocate significant resources to the customization and integration of these technologies into their existing workflows. The development phase often requires hiring specialized personnel, conducting comprehensive training, and implementing rigorous testing protocols to ensure that the system meets the demanded accuracy levels.

Moreover, the initial investment includes the procurement of necessary hardware, such as high-performance servers and storage solutions, which are essential for running complex AI algorithms. Financial institutions may also need to invest in software development tools, data preprocessing technologies, and integration platforms to ensure seamless connectivity between AI systems and existing organizational workflows. The cumulative cost of these components can be substantial, highlighting the need for careful budget planning and resource allocation.

Ongoing Maintenance

One of the critical aspects of AI-based data extraction systems is their need for continuous maintenance and updating. AI models require regular fine-tuning to adapt to evolving data types, regulatory changes, and emerging trends in financial documentation. This ongoing effort is resource-intensive, involving continuous monitoring, performance evaluation, and periodic retraining of models with new datasets. The evolving nature of financial documents means that any AI system deployed must remain dynamic and adaptable to ensure sustained accuracy and relevance.

Firms must be prepared for the long-term commitment required to maintain these systems. This includes setting aside budgets for ongoing research and development, hiring personnel who can manage updates, and investing in continuous learning and improvement programs. Regular maintenance tasks, such as bug fixes, software updates, and model retraining, are crucial for ensuring the reliability and robustness of the AI system. Failure to invest in these areas can lead to system degradation, ultimately compromising the accuracy and effectiveness of the data extraction process.

Ensuring Accuracy

High Stakes of Inaccuracies

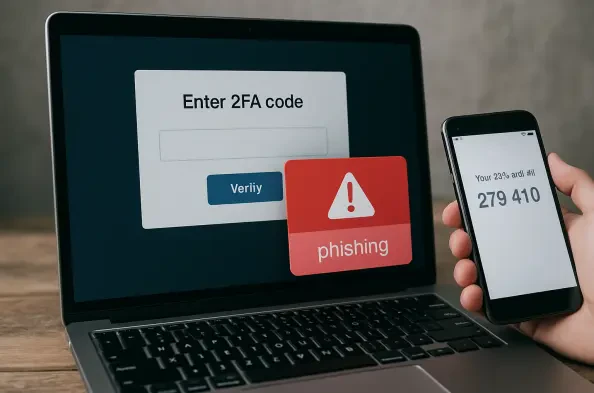

Accuracy is of paramount importance in using AI for data extraction, particularly in the financial sector where the stakes are incredibly high. The financial consequences of inaccuracies can be severe, ranging from fines and legal repercussions to reputational damage. Regulatory compliance is a critical aspect of financial operations, and any errors in data extraction can lead to non-compliance, which comes with significant penalties. Therefore, ensuring 100% accuracy is non-negotiable when deploying AI for data extraction in financial documents.

Inaccuracies in data extraction can also lead to misguided decisions, impacting the financial health and strategic direction of a firm. For example, erroneous financial data can distort key performance indicators, leading to incorrect assessments and potentially costly decisions. The ripple effect of such inaccuracies underscores the importance of deploying highly accurate and reliable AI systems. To mitigate these risks, firms must ensure thorough testing, validation, and quality assurance processes are in place throughout the AI system’s lifecycle.

Limitations of Generic AI Models

Generic AI models, while powerful, often fall short when it comes to handling the nuances of financial documents. These models are typically designed to understand and process general language and may lack the specificity required for financial texts, which are often laden with industry-specific terminology, regulatory clauses, and context-dependent information. As a result, generic AI solutions may misinterpret or overlook critical details, leading to inaccuracies that can be costly and detrimental to financial operations.

To address these limitations, significant modifications and customizations are necessary. Financial institutions must adapt generic AI models by training them on domain-specific data, incorporating rules and heuristics relevant to the financial sector, and fine-tuning their algorithms to recognize and process specialized vocabulary and formatting. This process not only enhances the accuracy of the AI systems but also ensures they are capable of meeting the stringent requirements associated with financial data extraction. With precise customization, AI models can achieve the level of detail and fidelity required to handle complex financial documents effectively.

Balancing Expectations and Commitment

Substantial Commitment Required

Implementing AI for data extraction in financial documents demands a substantial commitment from financial institutions. It is not a plug-and-play solution but requires a strategic approach involving significant financial investments, technical expertise, and ongoing management. Firms must recognize that achieving an effective and reliable AI system is a complex and iterative process, necessitating patience and sustained effort. This commitment includes the initial setup, customization, integration, and continual optimization of AI systems.

Moreover, the commitment encompasses the broader organizational changes required to support the integration of AI technologies. This may involve redefining existing workflows, training employees to interact with and manage AI systems, and fostering a culture of innovation and adaptability within the institution. The goal is to ensure that the AI systems are fully integrated into the organizational fabric and are capable of delivering long-term value.

Long-Term Strategic Approach

The integration of artificial intelligence (AI) into the extraction of data from financial documents both showcases immense potential and poses significant challenges. This discussion explores the intricacies involved in the deployment of AI technologies for this vital function. It highlights the various technological hurdles, considerable financial investments, and concerns regarding accuracy that companies must address. Although the strides in AI development promise highly effective solutions, the path to implementation is filled with complexities. Companies must navigate obstacles such as ensuring data security, managing large volumes of information, and adapting AI models to handle diverse financial documents. These challenges underscore the importance of a meticulous approach to integrating AI, as even small errors in financial data extraction can lead to significant repercussions. While AI has the power to revolutionize how financial data is processed, achieving seamless integration requires careful planning and substantial resources. This blend of opportunity and difficulty encapsulates the current landscape for businesses employing AI in financial data extraction.