In today’s digital age, financial vulnerability has made many people susceptible to the lure of quick and easy loans provided by online apps. These applications often promise fast cash with minimal documentation and flexible repayment terms. However, what many users are not aware of is that these seemingly harmless loan apps can be sophisticated tools for data theft and extortion. SpyLoan apps like SpyLend pose a significant threat by exploiting personal information, leading to blackmail, harassment, and severe financial and psychological repercussions. It’s crucial to identify, understand, and avoid these malicious apps to protect your sensitive data.

1. Steer clear of sketchy loan apps

Beware of applications offering fast loans with minimal documentation because these too-good-to-be-true offers often disguise malicious intent. Many of these fake loan apps, such as SpyLoan apps, are designed to steal your personal information rather than assist with your financial needs. Developed to lure in individuals already facing financial hardships, these apps gain trust by promising easy access to money. Once you download and install the app, it starts harvesting sensitive data including your contacts, images, and files.

These apps often don’t even bother providing any loans; they just grab your data and begin the process of harassment and extortion. Users frequently report receiving threats of leaking private photos, unauthorized access to contacts, and even deepfake creation using stolen images. The consequences of these actions are dire, leaving victims not only financially compromised but also living in constant fear due to the threats and blackmail. Therefore, it’s critical to stay vigilant and avoid apps that offer unrealistic loan conditions.

2. Use robust antivirus programs

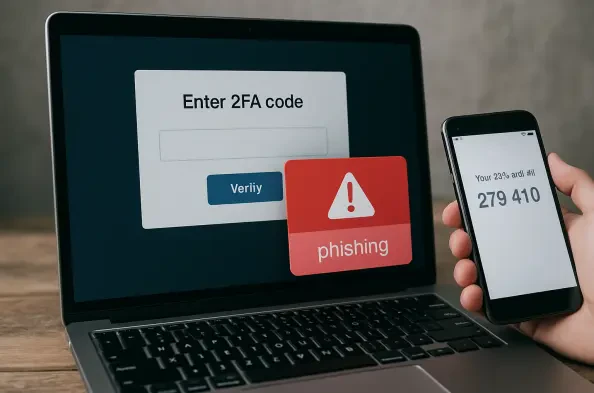

Another essential protection strategy involves the installation of strong antivirus software on all your devices. These programs can help detect and prevent the installation of malicious apps, thus safeguarding your data from being stolen. Robust antivirus protection doesn’t just stop at detecting fake loan apps; it also shields your device from ransomware scams, phishing emails, and other types of malware.

The best antivirus programs provide real-time protection against emerging threats and offer regular updates to stay ahead of cybercriminals. While some antivirus software comes at a cost, the investment is a small price to pay for the security and peace of mind they offer. These programs can also alert you about potentially harmful websites and downloads, helping you avoid threats before they reach your device. By having a comprehensive antivirus solution in place, you’re adding a significant layer of security to your digital life, making it harder for malicious apps to compromise your data.

3. Get apps from trustworthy platforms

When downloading apps, it’s important to stick to reliable sources such as the Google Play Store or Apple’s App Store. While no platform can guarantee absolute safety, these official app stores have stricter checks and balances compared to third-party sources. The Google Play Store, for example, employs multiple layers of security measures to prevent the distribution of malicious software. This includes rigorous app review processes and advanced detection systems designed to flag potential threats.

However, even with these security measures, users should remain cautious. Google Play Protect, the built-in security feature, can warn or block known malicious apps, but it isn’t infallible. Therefore, it’s best to combine this with your diligence. Avoid downloading apps from unknown websites or click links sent via SMS or email, which can be deceptive and harmful. Staying vigilant and opting for apps from reputable sources significantly reduces the risk of falling victim to fake loan apps and other malware.

4. Examine app permissions carefully

Before installing any app, it’s crucial to review the permissions it requests. Legitimate financial apps should only ask for permissions relevant to their functions. However, fake loan apps often request excessive and unnecessary permissions such as access to contacts, call logs, storage, and even messaging. These permissions allow the app to gather a substantial amount of personal data, which can then be used for malicious purposes.

If an app’s permission requests seem invasive or unrelated to its stated function, it’s a red flag. Users should be wary of installing such apps and instead look for alternatives that require minimal permissions. By carefully examining these requests, you can avoid apps that aim to gather and misuse your personal information. Always remember, a legitimate app should respect your privacy and only request necessary permissions.

5. Read reviews and watch for warning signs

Reading user reviews and looking for red flags before installing any financial app can save you from falling into the trap of fake loan apps. Reviews are valuable as they provide firsthand experiences of other users who might have encountered issues such as harassment, blackmail, or excessive permissions. If multiple reviews mention suspicious activity, it’s best to steer clear of that app.

Also, watch out for warning signs such as complaints about invasive permissions or threats received from the app’s operators. It is crucial to pay attention to these indicators and avoid downloading any app with such feedback. Trust the community of users who take the time to share their experiences, as this collective wisdom can often reveal hidden dangers that might not be apparent at first glance.

6. Report and delete dubious apps

If you encounter a SpyLoan app or any other suspicious application, the first step should be to uninstall it immediately and revoke its permissions. Following this, report the app to the relevant authorities such as the Google Play Store, cybersecurity authorities, and financial regulators. This helps prevent further victims from falling prey to these malicious schemes.

If you believe your personal information has been compromised, it’s important to secure your accounts by changing passwords and monitoring for any unusual activity. Using a password manager can significantly enhance your security by generating and storing complex passwords. Additionally, consider reporting any fraudulent activity to your financial institutions so they can monitor and protect your accounts. Taking these proactive steps can mitigate the impact of these malicious apps and help others avoid similar experiences.

Importance of Financial Vigilance

In today’s digital era, financial insecurity has led many individuals to fall for the temptation of instant, hassle-free loans offered by online apps. These apps often entice users with the promise of quick cash, minimal paperwork, and flexible repayment plans. However, many are unaware that these seemingly benign loan applications can be intricate tools for data theft and extortion. For instance, SpyLoan apps like SpyLend present a significant risk by exploiting personal data, which can result in blackmail, harassment, and severe financial and psychological consequences. The urgency to identify, comprehend, and steer clear of these malicious apps is paramount to protect your sensitive information. It’s important for users to remain vigilant, conduct thorough research, and only use trustworthy financial platforms. Being aware of the potential dangers and the signs of a malicious app can safeguard your personal information and prevent unwelcome stress and financial loss in the long run.